Understanding Halal Investments In India

Halal Investments In India will be successful on the condition that they are to be done through the actual process guided by Islamic Sharia. Unfortunately, today many Muslim Business do haram transactions in the name of Halal Business. And many Muslim Investors expect haram payments in the name of Halal Profits. Emaan Invest follows the actual sharia based investment process which gives you profits and peace of mind. By following this process, you can earn Halal Profits and be tension free about your investments.

1. Fix Duration: Invest your amount for a fixed duration. This will help us to plan your investments properly and run the business smoothly. The ideal durations are 1 months, 3 months, 6 months, 12 months, 1-5 Years. Always invest long term to get regular profits. You can start with a small duration and gradually increase based on returns on your investment. You will be contacted one month in advance to confirm your continuation or refund of your investment. Once your duration of investment is completed, your investment will be automatically refunded with profits.

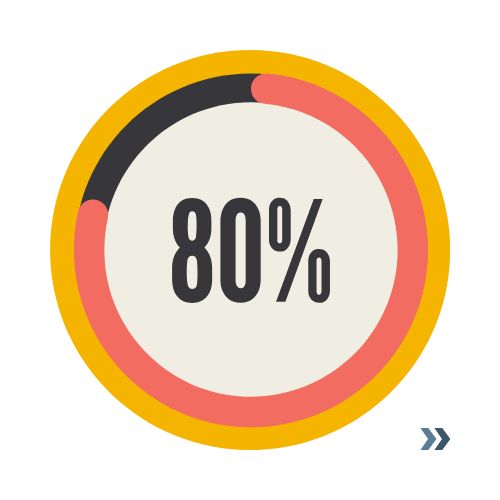

2. Profit Percentage: Halal Investment gives you profits as percentage share but not as fixed income. Fixed income falls in the category of interest and it is haram to collect such income on your investment. And please remember, you can never demand profits. We can share from only what we earn. The standard Share according to Emaan Invest is 80% Investors and 20% The Management. For example, if the company is earning a profit of Rs. 10,000/-, then all the investors combined will get a share of Rs. 8000/- and the management shall take share of Rs. 2000/-.

Many investors demand profits irrespective of less earnings to the company. This makes your investment haram and the source to fail your business. If the investors accept loss and forgo payments in such situation, then your investment will be halal and the company will sustain this period and grow further without failing. This process makes the businesses halal and sustainable. In a successful business, loss in temporary and profits are long term. It is important for investors to understand, that earning profit is also halal and making loss is also halal. But unfortunately Muslims today consider Profits to be halal and if a company makes some loss then they call it fraud. This is strictly against Islamic concept of halal business. Emaan Invest is working hard to create genuine information about Halal Investments In India